property tax bill las vegas nevada

Las Vegas NV 89106. Las Vegas NV 89106.

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

06765 24215.

. Las Vegas NV 89155-1220. 123 Main St City State and Zip entry fields are optional. The assessed value is equal to 35 of the taxable value.

Real Property Tax Due. The property tax rates for most all of Clark County range from 24863 to 33552 for the tax year 2008-2009. Las Vegas City Fire Safety.

Tax bills requested through the automated system are sent to the mailing address on record. 500 S Grand Central Pkwy. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites.

Mar 31 2009. Checks for real property tax payments should be made payable to Clark County Treasurer. Las Vegas NV 89106.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. 702 455-4323 Fax 702 455-5969. 8 hours agoLas Vegas NV 89146.

Future Due Dates. If you already use online bill. If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy.

Las Vegas Nevada 89155-1220. 1st Quarter Tax Due - 3rd Monday of August. Property Tax Rates for Nevada Local Governments Redbook.

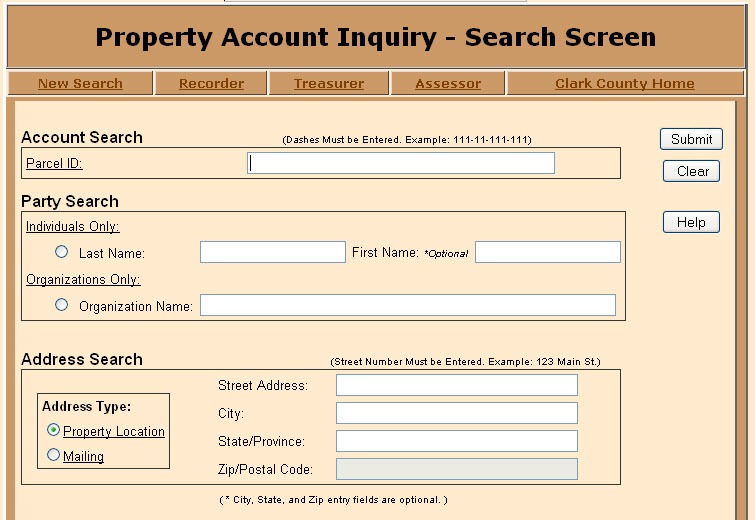

The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. Account Search Dashes Must be Entered. 3rd Quarter Tax Due - 1st Monday of January.

A 150 fee will be applied for all E-check payments. Office of the County Treasurer. Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year.

The appeal form must be obtained from the county assessor and filled out completely in Clark County call 702 455-3891. 051 effective real estate tax rate. 055 effective real estate tax rate.

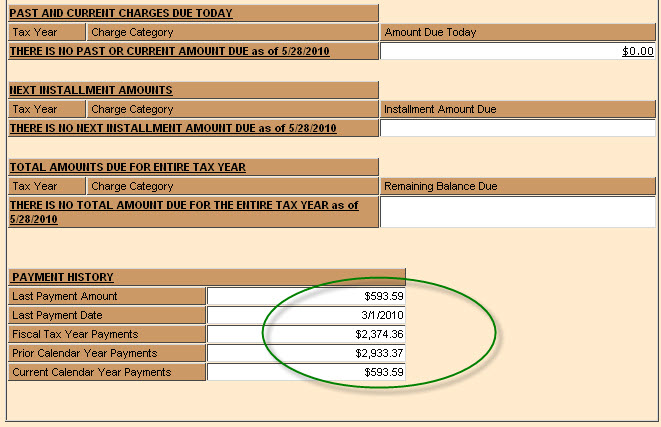

For further information on Lodging Tax Authorities please contact our Department at 775 684-2000. Real Property Tax Due Dates. To ensure timely and accurate posting please write your parcel numbers on the check and include your payment coupons.

Be prepared to provide the parcel ID number. As compared to other major cities around the country Las Vegas property tax rates are some of the lowest in the United States at an effective rate of about a dollar per 100 of assessed value. Pay Monthly Parking Permits.

While supporting an especially high sales tax rate of 775 much of that bite is ameliorated by the fact that Nevada only taxes 374 of its goods at sale. Taxes are delinquent 10 days after due date. Apply for a Business License.

Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected. To make an online payment you will need to use a different browser such as Google Chrome which can be downloaded for free. Las Vegas NV 89106.

Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. You are then taxed at the above rates for every 100 of assessed value. 2nd Quarter Tax Due - 1st Monday of October.

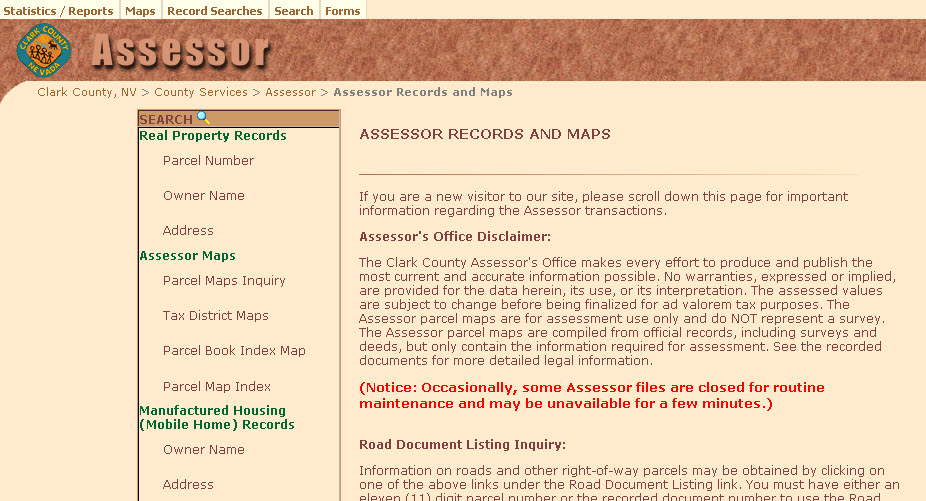

Property Account Inquiry - Search Screen. Plus receive a detailed rundown of property characteristics. In-depth Clark County NV Property Tax Information.

If you did not receive a tax bill you can request a bill by calling our office at 702 455-4323 and selecting option 3 from the main menu. We are open 730 am. Facebook Twitter Instagram Youtube NextDoor.

500 S Grand Central Pkwy 1st Floor. Tax bills requested through the automated system are sent to the mailing address on record. Las Vegas NV 89155-1220.

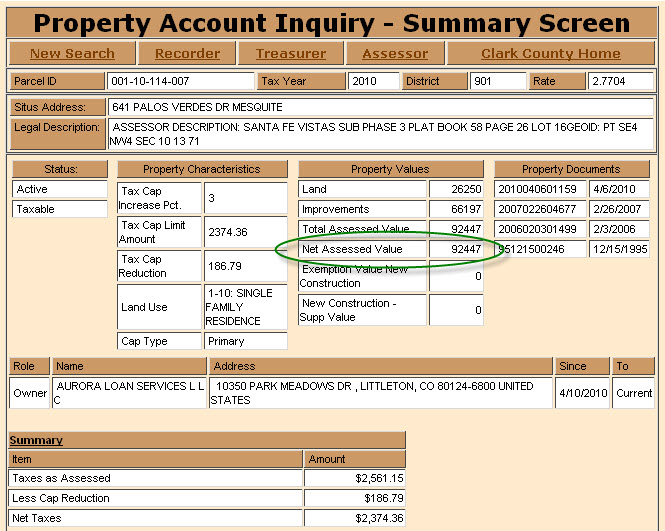

Grand Central Pkwy Las Vegas. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be 35000. A home that is found to be valued at 200000 and given that the property is assessed at 35 of current value this home would show an assessed value of 70000.

Grand Central Pkwy Las Vegas. Then in 2005 with values skyrocketing lawmakers decreed an increase in the tax bill of the owner of a home by more than 3 percent over the tax bill of that homeowner for the previous. In addition Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes.

- 530 pm Monday through Thursday except for holidays. The county board of equalization hearings will begin in January and must be concluded by the end of February. Compared to the 107 national average that rate is quite low.

Grand Central Pkwy Las Vegas NV 89155. 1 day agoLAS VEGAS In 2007 not long before Las Vegas frenzied real estate market imploded Nevada lawmakers approved a seemingly minor tweak to a tax law. Real Property Tax Payment Schedule Nevada.

A 395 fee will be applied for Visa Signature Debit payments. If you did not receive a tax bill you can request a bill by calling our office at 702 455-4323 and selecting option 3 from the main menu. Tax rates apply to that amount.

Pay fees for permits licenses sewer bills Municipal Court citations parking tickets and more. Overall at least two dozen or so transactions in the Las Vegas area totaling 275 billion have closed since 2007 without any publicly reported real. 702 455-4323 Fax 702 455-5969.

Las Vegas City Hall. A 25 fee will be applied to all credit card payments with a minimum charge of 200. If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy.

Doing Business with Clark County. Find My Commission District. The states average effective property tax rate is just 053.

Any specific questions regarding exemptions and rates should be addressed to the citycounty where the hotel is located. NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Property owners can represent themselves at the hearing but must.

Make Real Property Tax Payments. 4th Quarter Tax Due - 1st Monday of March. Make Personal Property Tax Payments.

In 1979 spurred by Proposition 13 in neighboring California Nevada legislators set the property tax rate at a maximum of 364 per 100 of assessed value. The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. 111-11-111-111 Address Search Street Number Must be Entered.

Get a complete overview of all of the factors that determine your selected propertys tax bill with a full property report. Las Vegas NV 89101 Phone. The change ensured property owners could.

You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. You may pay in person at 500 S Grand Central Pkwy Las Vegas NV 89106 1st floor behind the security desk.

Las Vegas NV 89106. KNPRs State of Nevada. 1st Floor behind security Las Vegas NV 89155-1220.

You may know the property tax cap is 3 and any increase is tied to an increase in the value of my home. In Nevada transient lodging tax and exemptions are set at the citycounty level and varies by county. Find information about and pay the assessments of any property in the city.

Treasurer - Real Property Taxes.

24 Sawgrass Ct Las Vegas Nv 89113 Realtor Com Las Vegas Vegas The Neighbourhood

Mesquitegroup Com Nevada Property Tax

Circus Circus Casino Vegas Hotel Vegas Old Vegas

Advantages Of Solar Air Conditioning Solar Air Conditioning Visual Ly Conditioner Solar Power Grid

Mesquitegroup Com Nevada Property Tax

What Is The Tax Impact Of A Short Sale Mortgage Payment Bank Owned Homes Homeowners Insurance

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Bills

San Diego Property And Supplemental Taxes What You Sh

Developer Plans Apartment Tower Near Downtown Las Vegas Downtown Las Vegas Las Vegas Real Estate Las Vegas Boulevard

Home Closing Delayed How To Plan What Happens If You Selling House

Mesquitegroup Com Nevada Property Tax

Taxpayer Information Henderson Nv

Your Tax Assessment Vs Property Tax What S The Difference